SoftLedger also supports crypto accounting (and crypto payments) in the AR process. Centime’s streamlined AR software enables businesses to easily track KPIs like Days Sales Outstanding (DSO), Collections Effectiveness Index (CEI), and more. When CentimePay is used, Centime provides automatic cash application to those receivables.

How do I automate the accounts receivable process and accelerate collections?

Get paid faster, improve collections effectiveness, and reduce overdue payments directly within your ERP. Focus your collections efforts on the most impactful invoices for your business and unlock an accurate view of your future cash flows with Centime’s accounts receivable automation software. We help your team preserve adequate liquidity and predict payment delays with the use of AI. Accounts receivable automation refers to using technology to automate a variety of tasks and processes involved in managing the money owed to a business by its customers. This encompasses a range of activities, such as generating invoices, sending payment reminders, reconciling incoming payments, and producing financial reports related to receivables.

The key to success here is to first evaluate your needs and then choose one of the tools that can help you be more efficient. When you have how to prepare for an audit the right tools, AR automation will not only help your business grow, but it will also save you time. These are just some of the key KPIs to measure the effectiveness of your accounts receivable process. This step also ensures the invoices (or bills) are sent to the right customers and reach customers at the right time, without any errors. Accounts receivable automation delivers key CX gains and alleviates customer frustrations, boosting their attitudes toward your business.

The following guide explores the most common AP pain points and shares the top solutions to simplify and streamline your receivables. While both AP and AR both affect your cash flow, they are fundamentally opposite. More specifically, AP automation refers to any technology that digitizes part of or the entire AP workflow, while AR automation refers to tools that optimize the AR workflow. Improve collections effectiveness, reduce overdue payments and boost working capital with our powerful AR automation software. They give accurate and helpful information on the right KPIs, like DSO, aging reports, cash flow reports, and collection effectiveness index (CEI), and enable you to make strategic financial decisions.

Latest Articles

It aims to reduce fraud and vendor impersonation how to compile and use income statement by providing clients with an invoice network to send invoices/payments and store documents. Are you tired of the complexities and challenges in managing your accounts receivable (AR) process? Are late payments, manual collections, and cash posting causing repeated headaches for your business?

HighRadius: Best Solution for Teams with Complex Cash Application Processes

We at Chargebee Receivables understand that collecting receivables is a two-way process. Before you purchase AR automation software, make sure it integrates with the other ERP software systems you use, like your accounting software, and other accounting integrations. By implementing effective accounts receivable automation, you can streamline and simplify your AR processes to make everything and everybody more efficient. This step enables customers to make B2B payments on their invoices easily with their preferred mode of payment. So you’ll need to configure the part of the app that controls the templates for reminders and determine just how often you want payment reminders to be sent out. Collecting cash is the lifeblood of any business, and as an accounting firm, we need to know how to help our clients collect cash in the easiest way possible so that their businesses can grow.

- Beyond work, she’s a culinary enthusiast who infuses her travels with local flavors.

- The administrative burden of manual data entry and reconciliation processes can be time-consuming and prone to errors.

- Simon Litt is the editor of The CFO Club, specializing in covering a range of financial topics.

- They give accurate and helpful information on the right KPIs, like DSO, aging reports, cash flow reports, and collection effectiveness index (CEI), and enable you to make strategic financial decisions.

- This point could be missed if you are only focused on selecting the right AR automation software.

Resolve Team

This is one of the most popular features every AR automation software tends to have. Learn more about average collection periods and AR KPIs, and what makes sense for you to measure. You can make better strategic decisions when you are aware of these metrics (and have quick access to them) through automated dashboards. Your accounting department and finance team are familiar with the day-to-day AR operations so they are in the best position to share the biggest gaps and challenges in the process. Even if you’re already utilizing general accounting software like QuickBooks, adding a dedicated AR automation solution is worth looking into.

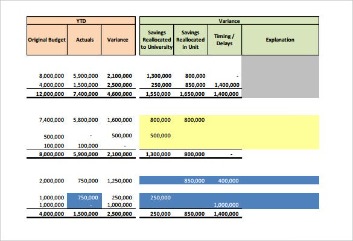

This step ensures all payments made by customers are reconciled and matched to the outstanding AR balance in your accounting system and accounts receivable sub-ledger. BlackLine automates many key components of the AR process, from invoicing and payment matching to past-due collections and dispute management. Standout features include all-in-one functionality for invoicing and basic accounting, as well as built-in time tracking, professional invoicing, and integrated payments. Based on a combination of features like user-friendliness, functionality, and value, these are the best accounts receivable automation solutions on the market today. Accounts receivable automation brings accuracy, efficiency, and key advantages to businesses across sectors. Whether a business is looking for faster billing, stronger compliance, or more insightful analytics, automation serves as an effective solution for managing how to plan create use budgets. budget variance analysis steps. accounts receivable complexities.

Be First to Comment